For generations, people in Malaysia have trusted the public healthcare system for affordable medical services. Hospitals and clinics provide essential care, with costs heavily subsidised by the government. Yet, the landscape is evolving. Healthcare expenses are rising, waiting times can be long, and specialised treatments—often needed for critical illnesses—are becoming costlier and less accessible in the public system. Many families are beginning to feel the financial pinch when faced with serious health challenges.

While Malaysia’s healthcare remains more affordable than in many countries, out-of-pocket costs for long-term illness, recovery, and end-of-life care are rising. Malaysians are now asking: Is relying on public hospitals and personal savings enough to protect our families from the financial impact of a major health crisis?

This article explores how healthcare inflation is changing the risks for every Malaysian and why a solid protection strategy goes well beyond simply paying off debts—it’s about securing your family’s future against the unpredictable, rising costs of staying healthy.

The Hidden Costs Beyond Public Healthcare

Malaysia’s public healthcare system provides vital services at low fees, but it does not cover everything. Many families encounter high costs during prolonged illnesses, especially when seeking faster or better care in private facilities.

The Expense of a Long-Term Illness

Long-term medical conditions like cancer, heart disease, or stroke can lead to a myriad of extra expenses:

- Travel and Accommodation: Regular trips to city hospitals or specialist centres may involve transportation, accommodation, or even loss of earnings for accompanying family members.

- Home Modifications: Installing ramps, handrails, or accessible bathrooms to allow mobility for those recovering at home.

- Specialist Equipment: Medical devices, wheelchairs, or home care aids, many of which aren’t subsidised.

- Private Care and Therapies: Malaysians increasingly opt for private physiotherapy, alternative treatments, and counselling to get better quality and faster service than what’s available in the public system.

These expenses can quickly drain family savings, adding stress during an already difficult time.

The Turn to Private Healthcare

Crowded government hospitals and long waiting times push many Malaysians toward private clinics and hospitals for quicker attention and better facilities. However, private healthcare comes at a high price. A single hospital admission or procedure can cost tens of thousands of ringgit, and even an MRI scan or routine operation can be a major expense.

If you don’t have adequate insurance or a large emergency fund, these bills can derail savings meant for other milestones like a child’s education or retirement.

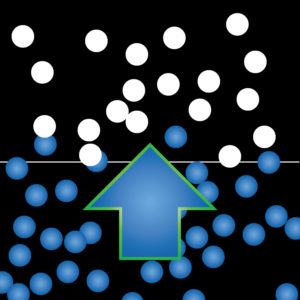

Critical Illness Cover: The First Line of Defence

This is where a form of Life protection insurance, Critical Illness Cover, offers real value. This type of insurance pays a lump sum if you are diagnosed with a specified serious illness.

These funds can provide crucial breathing space, helping to:

- Cover private hospital fees or treatment not fully covered by public healthcare.

- Support home modifications or the purchase of medical aids.

- Fund alternative or overseas treatment options.

- Allow a spouse or parent to stop working temporarily to provide care.

This immediate payout prevents a health emergency from spiraling into a financial crisis, allowing your family to focus on recovery rather than money worries.

Protecting Your Income When You Can’t Work

A major illness not only increases expenses, but it can also wipe out your income. Most Malaysians have limited access to social security benefits, and payouts from the Social Security Organisation (SOCSO/PERKESO) or EPF savings may not fully replace your monthly income, especially if you have dependents or ongoing commitments.

Income Protection policies are designed for this scenario. If illness or accident prevents you from working, these plans provide a regular income—ensuring essentials like loan repayments, utilities, and groceries are still covered. Meanwhile, savings or critical illness payouts can be used to cover medical expenses. This approach protects your day-to-day financial stability during tough times.

The End-of-Life Cost Burden

End-of-life care can be expensive, especially when seeking comfort, dignity, and specialist support for terminal illnesses. While government hospitals provide palliative care at minimal cost, many families choose or require private caregiving, which involves monthly fees for in-home nurses, medications, or dedicated facilities. These costs can easily reach thousands of ringgit per month, quickly exhausting even sizable savings.

A Whole of Life insurance policy—guaranteed to pay out no matter when the insured passes away—can offer a vital lifeline, ensuring your family can pay for the best possible care without sacrificing their inheritance. Placing policies in trust can help expedite payouts and ensure the money is available when it’s needed most.

The Domino Effect on Loved Ones

Financial pressures from healthcare costs rarely affect only the patient—they ripple through the entire family.

The Carer’s Sacrifice

Frequently, a spouse, sibling, or adult child steps up as a caregiver, often cutting work hours or putting their career on hold. This results in loss of income now and can negatively affect future EPF contributions and retirement plans.

The Strain on Savings

Family savings earmarked for education, property, or retirement can be quickly depleted by just a few years of medical bills and care costs, potentially setting back the family’s financial progress for many years.

Comprehensive life protection is key to breaking this cycle. Insurance payouts can fund the care you need, letting your family remain supportive without sacrificing their own well-being or plans.

Conclusion: Insurance as a Pillar of Modern Healthcare Planning

Ideally, healthcare would never be a source of worry for Malaysian families. In reality, as costs rise faster than incomes and public resources are stretched thin, personal financial planning becomes essential.

Relying solely on savings is risky—a single serious illness can undo decades of careful budgeting. True security means shifting some of that risk to a trusted insurer.

Life protection in Malaysia is about more than just paying off a mortgage or covering debts. It forms the bedrock of a proactive financial strategy, combining term assurance, critical illness cover, and income protection to tackle every angle: replacing lost income, paying unexpected medical bills, and securing your family’s ambitions.

As medical costs climb, a robust insurance plan becomes more important than ever. Only then can you be sure that a health emergency doesn’t become a lifelong financial setback for those you love most.